Bayhawk Properties is a real estate investment firm that acquires and operates multifamily communities in U.S. markets supported by population growth, employment diversity, and durable renter demand.

Through a strategic partnership with an owner-operator of more than 20,000 units across 18 states, Bayhawk gains access to a scalable and vertically integrated platform. With in-house property management, leasing, and construction teams, we benefit from a structure that supports efficient execution and consistent delivery. This foundation, strengthened by on-the-ground relationships, enhances deal flow and streamlines market entry.

Bayhawk deploys discretionary capital on a deal-by-deal basis, committing only when an opportunity meets our standards and return targets. We invest based on merit, not fund mechanics or timelines.

We focus on opportunities with a clear path to operational improvement and long-term value creation. Every investment is grounded in disciplined underwriting, thoughtful structuring, and hands-on oversight from acquisition through stabilization.

Bayhawk targets Class B and C multifamily properties where operational enhancements, targeted capital investment, or balance sheet realignment can unlock value. We focus on opportunities where active oversight and disciplined execution improve performance, increase revenues, and enhance asset value.

Each acquisition is guided by a detailed financial review. We analyze historical operations, evaluate rent potential through market surveys, and validate assumptions using third-party and in-house portfolio comp data. Expense projections are benchmarked against real-time figures drawn from a 20,000-unit portfolio, providing direct insight into staffing, maintenance, insurance, and contract pricing across our markets. This approach ensures that every business plan is grounded in actual performance and structured for execution from day one.

Marc Douglas is a real estate investment professional with a proven track record of sourcing, executing, and managing the full deal cycle across multiple asset classes. Over his career, he has led over $375M in transactions across multiple asset classes. As the Founder of Bayhawk Properties, he leads acquisition strategy, deal structuring, and investment execution in high-growth markets, consistently delivering strong risk-adjusted returns through a data-driven approach.

Previously, Marc was a principal at Urban West Capital, where he built and stabilized a $50M+, 220-unit multifamily portfolio in Reno, NV, executing a value-add strategy during a period of market volatility. His earlier roles at ZT Realty, BEB Capital, Walter Samuels, and CLK Properties honed his expertise in sourcing off-market deals, financial analysis, and asset management.

Marc combines institutional experience with entrepreneurial agility to position Bayhawk Properties as a trusted platform for performance-focused real estate investments.

Bayhawk invests in metros with meaningful population growth, job diversification, and infrastructure investment. We prioritize markets where economic expansion is supported by sectors such as education, healthcare, technology, logistics, and advanced manufacturing.

We focus on markets with favorable rent-to-income dynamics, limited new supply relative to demand, and a growing affordability gap between renting and homeownership.

Bayhawk maintains an active presence in more than 20 U.S. cities, providing deal flow and visibility into local market dynamics. We source deals through both off-market relationships and marketed transactions, giving us consistent access to high-quality opportunities.

Bayhawk aligns with a select group of limited partners through a committed discretionary capital structure. Capital is called on a deal-by-deal basis.

This structure allows us to:

• Remain opportunistic without deployment pressure

• Avoid fixed timelines or forced exits

• Match capital to the needs of each opportunity

Our decisions are driven by market dynamics, not artificial timelines. We buy or sell only when opportunities meet our criteria.

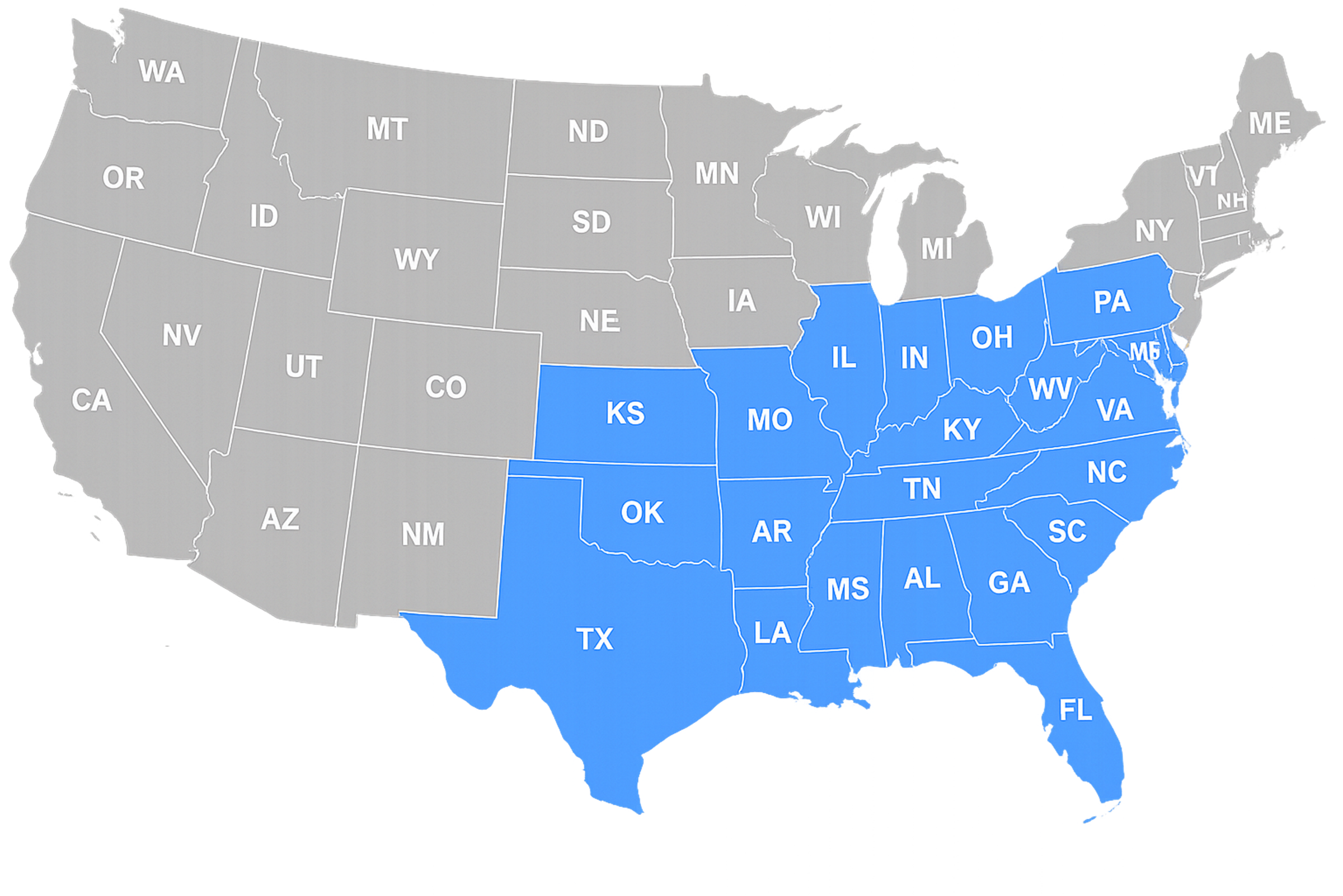

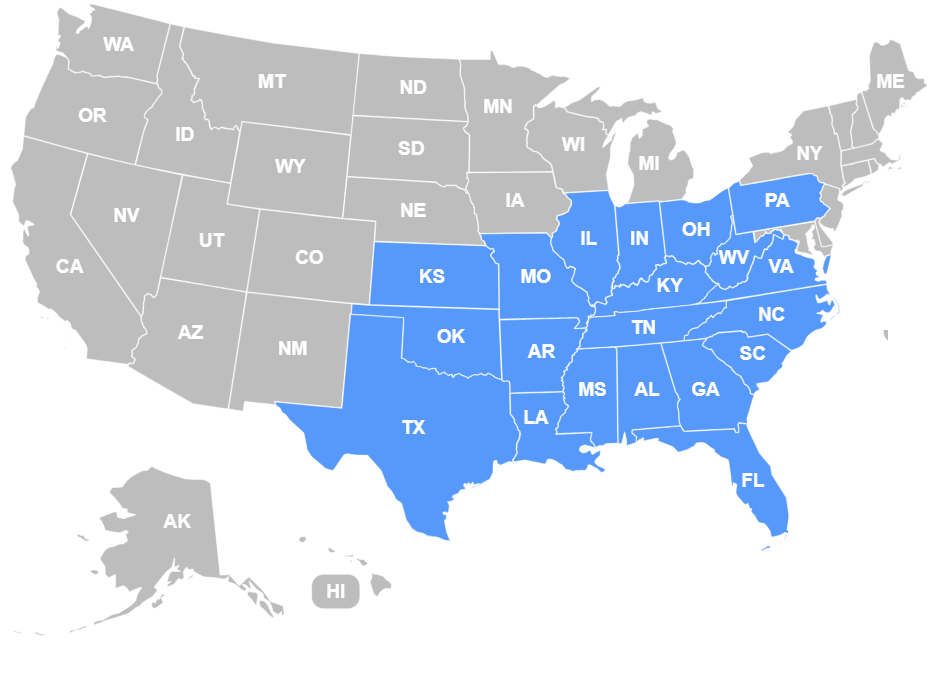

Map reflects Bayhawk’s active presence across 20+ target markets.

Bayhawk focuses on markets with strong job and population growth, sustained rental demand, and favorable rent versus ownership dynamics.

With active deal flow across more than 20 cities, we maintain a consistent pipeline of actionable opportunities.

Our local relationships and operating platform allow us to underwrite quickly, enter new markets efficiently, and manage assets effectively for long-term performance.

Map reflects Bayhawk’s active presence across 20+ target markets.

Bayhawk focuses on markets with strong job and population growth, affordability relative to homeownership, and sustained rental demand.

With active deal flow across more than 20 cities, we maintain a consistent pipeline of actionable opportunities. Our local relationships and operating platform allow us to underwrite quickly, enter new markets efficiently, and manage assets effectively for long-term performance.

See map below pulled from – the powerpoint I provided to your team

Bayhawk raises committed discretionary capital from like-minded LPs, called upon on a deal-by-deal basis.

This structure allows us to:

Our decisions are driven by market dynamics, not artificial timelines. We buy or sell only when opportunities meet our criteria.

Disclaimer: Track record includes deals acquired prior to launching Bayhawk Properties.

This is a real deal executed by Bayhawk’s founder while at Urban West Capital. It illustrates a proven value-add strategy applied to a high-growth, supply-constrained submarket. The deal is currently held with the business plan fully implemented.

Marc Douglas, Founder & Principal

Marc Douglas has led more than $375 million in multifamily transactions, with a focus on acquisitions, value-add execution, and asset performance. He founded Bayhawk to invest in resilient markets with the discipline and flexibility required in today’s environment.

Prior to Bayhawk, Marc co-led the acquisition and repositioning of a 220-unit, $50 million portfolio in Reno, Nevada, as a principal at Urban West Capital. Earlier in his career, he held investment roles at ZT Realty, BEB Capital, and Walter & Samuels, following an initial foundation in acquisitions and analysis at CLK Properties.

Marc’s experience across both institutional platforms and entrepreneurial environments informs Bayhawk’s focused, execution-driven approach.

Admin@bayhawk.com

(516) 400-1925

12 E 49th Street, New York, NY 10017